- Joined

- Nov 13, 2009

- Messages

- 45,544

- Reaction score

- 12,406

Updated Post 8/6/22

Been taking awhile to get to this but the tax side of the bill that concerns me is the minimum tax on corporations. Sure, you can have something like this but the way it's done can have unintended consequences. The bill ties the alternative calculation to book income. By linking the world of reporting that is relied on by investors, debt issuers, managers, etc with the world of tax compliance, you can get unnecessary pressure now from those reporting financials to try to massage income lower for a more favorable tax bill. But even outside of that individual pressure, those who make make the rules for GAAP (generally accepted accounting principles) in the US now have a power to impact taxation rather than the government. Their considerations for a policy change now directly impacts taxation rather than just the goal of making financials transparent and useful to those relying on them. Now one agency that regulates GAAP is the SEC, a federal agency. But the other is FASB (Financial Accounting Standards Board) which is a private agency. So in other words, this AMT proposal blurs taxable income and book income together and shifts some of those handling the definition to non-governmental officials who aren't even tasked with crafting good tax policy when determining what book income should be.

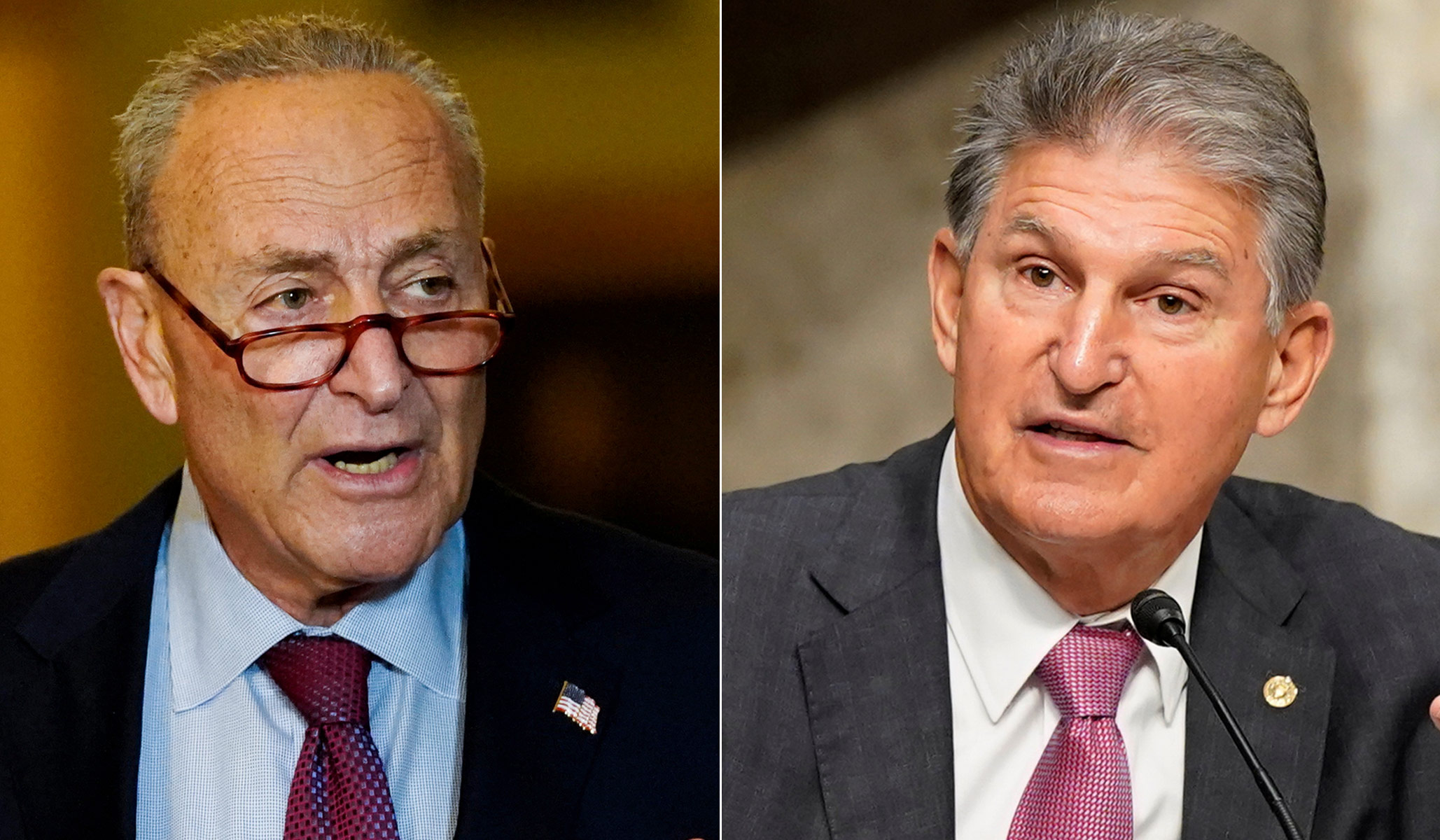

This is something the accounting community had concern for last year when it initially was being proposed. The AICPA (American Institute of CPAs) sent a letter to the Senate Committee of Finance and the House Ways and Means Committee about the issues that could arise from it. This is somewhat my a gripe I have with how this and many bills come through. There was behind the scenes discussions with two senators (Schumer and Manchin) and then we get a bill released that is getting voted on within a week or so of the agreement. Completely bypassing committees and combing through the details. Sure, Schumer and Manchin are using resources to try to make a good bill and likely borrowing from other iterations but this AMT part seems like ignorance in process for the greater goal of a political win trying to make corporations pay their fair share. What's even more interesting is Sinema got part of the AMT proposal adjusted to not ding manufacturers for the change as they would've gotten impacted a lot from not having bonus depreciation so that shift alone shows that maybe they should realize there are different goals that should be carefully look at between taxable and book income and it shouldn't be blended the way it is. Different audience and different purposes.

Some stuff to read up on this if you are interested:

The Summary Provisions related to Tax in the Inflation Reduction Act

AICPA Letter to Congress on Concerns of the AMT change

Meet the accountants who may become the new power brokers of taxes by New York Times

How the 15% US Minimum Corporate Tax Would Work by Bloomberg

What Is Biden’s Minimum Book Income Tax on Corporations? by The Tax Policy Center

Explaining the GAAP between Book and Taxable Income by The Tax Foundation

On the note of further items in on the tax side of the bill, here's a breakdown of the IRS funding portion. Beyond just enforcement, there are other things people might be more agreeable to, like modernization (like most agencies in the federal government, the IRS is very outdated with some of the technology they use) and a 9 month deadline on a plan to create their own e-filing system. They somewhat have a program like this but it largely got co-opted by turbo tax and some others and didn't help those who should've benefited. I'm all for the government getting the IRS to a place with most returns are fairly automated. Tons of American's really only have a W-2 when they file and even when they don't, there is a lot of required reporting outside of income to the IRS. Most countries use that reporting to populate a return, send it in the mail to the person, and have them either agree to the filing along with the amount due/refund or elect to edit it with something they missed. It's baffling we don't do this yet with no optimistic proposal in sight.

What The IRS Funding In The Inflation Reduction Act Means For Taxpayers

Forbes

I get cynicism about any progress. The projects could certainly go bad but I think a key bipartisan thing should be lets get the routine agencies the federal government runs to work efficiently. That saves Americans time, stress and money in the long term.

Been taking awhile to get to this but the tax side of the bill that concerns me is the minimum tax on corporations. Sure, you can have something like this but the way it's done can have unintended consequences. The bill ties the alternative calculation to book income. By linking the world of reporting that is relied on by investors, debt issuers, managers, etc with the world of tax compliance, you can get unnecessary pressure now from those reporting financials to try to massage income lower for a more favorable tax bill. But even outside of that individual pressure, those who make make the rules for GAAP (generally accepted accounting principles) in the US now have a power to impact taxation rather than the government. Their considerations for a policy change now directly impacts taxation rather than just the goal of making financials transparent and useful to those relying on them. Now one agency that regulates GAAP is the SEC, a federal agency. But the other is FASB (Financial Accounting Standards Board) which is a private agency. So in other words, this AMT proposal blurs taxable income and book income together and shifts some of those handling the definition to non-governmental officials who aren't even tasked with crafting good tax policy when determining what book income should be.

This is something the accounting community had concern for last year when it initially was being proposed. The AICPA (American Institute of CPAs) sent a letter to the Senate Committee of Finance and the House Ways and Means Committee about the issues that could arise from it. This is somewhat my a gripe I have with how this and many bills come through. There was behind the scenes discussions with two senators (Schumer and Manchin) and then we get a bill released that is getting voted on within a week or so of the agreement. Completely bypassing committees and combing through the details. Sure, Schumer and Manchin are using resources to try to make a good bill and likely borrowing from other iterations but this AMT part seems like ignorance in process for the greater goal of a political win trying to make corporations pay their fair share. What's even more interesting is Sinema got part of the AMT proposal adjusted to not ding manufacturers for the change as they would've gotten impacted a lot from not having bonus depreciation so that shift alone shows that maybe they should realize there are different goals that should be carefully look at between taxable and book income and it shouldn't be blended the way it is. Different audience and different purposes.

Some stuff to read up on this if you are interested:

The Summary Provisions related to Tax in the Inflation Reduction Act

AICPA Letter to Congress on Concerns of the AMT change

Meet the accountants who may become the new power brokers of taxes by New York Times

How the 15% US Minimum Corporate Tax Would Work by Bloomberg

What Is Biden’s Minimum Book Income Tax on Corporations? by The Tax Policy Center

Explaining the GAAP between Book and Taxable Income by The Tax Foundation

On the note of further items in on the tax side of the bill, here's a breakdown of the IRS funding portion. Beyond just enforcement, there are other things people might be more agreeable to, like modernization (like most agencies in the federal government, the IRS is very outdated with some of the technology they use) and a 9 month deadline on a plan to create their own e-filing system. They somewhat have a program like this but it largely got co-opted by turbo tax and some others and didn't help those who should've benefited. I'm all for the government getting the IRS to a place with most returns are fairly automated. Tons of American's really only have a W-2 when they file and even when they don't, there is a lot of required reporting outside of income to the IRS. Most countries use that reporting to populate a return, send it in the mail to the person, and have them either agree to the filing along with the amount due/refund or elect to edit it with something they missed. It's baffling we don't do this yet with no optimistic proposal in sight.

What The IRS Funding In The Inflation Reduction Act Means For Taxpayers

Forbes

Part 3 of H.R. 5376 spells out the specific allocations to the IRS to enhance the agency’s resources and improve compliance efforts. The breakdown is as follows:

Taxpayer services: $3,181,500,000;

Enforcement: $45,637,400,000;

Operations support: $25,326,400,000;

Business systems modernization: $4,750,700,000;

Task force to design free, direct e-file system: $15,000,000;

Treasury Inspector General for Tax Administration: $403,000,000;

Treasury Office of Tax Policy: $104,533,803;

Tax Court: $153,000,000; and

Treasury departmental offices for oversight and implementation support to help the IRS implement the IRA: $50,000,000.

Total: $79,621,533,803

I get cynicism about any progress. The projects could certainly go bad but I think a key bipartisan thing should be lets get the routine agencies the federal government runs to work efficiently. That saves Americans time, stress and money in the long term.

Last edited:

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/71180953/1241997068.0.jpg)