- Joined

- Dec 1, 2020

- Messages

- 7,135

- Reaction score

- 32,927

I reckon the mega-fab site will be in New York state

Y.

I reckon the mega-fab site will be in New York state

I'm optimistic about how aggressively they've undertaken measures with a focus on a return to engineering supremacy since they finally installed a CEO with an actual background in engineering. I like their short terms prospects far more than I did a few years ago. They seem less obsessed with the more esoteric functions of CPUs. Obviously, I was never a long-term bear on Intel. There is a long-running thread in the VG where I mock the profound ignorance required to believe that "Intel is fucked".Are you optimistic, @Madmick? The IDM 2.0 strategy is a series of really brazen and almost hyperambitious moves that would see Intel reaching a peak not seen since the turn of the century if they can pull it off and hit all of the production targets (when the stock will start soaring).

AMD designs world-class µP chips, Qualcomm rocks up eye-wateringly amazing SoC's and NVidia is crushing it with GPUs. It means something that they're based in the US and proprietary know-how is kept stateside - aside from when AMD is trying to cut joint ventures with CCP backed Chinese firms in China on the cheap - but it doesn't really do anything for the strength of America's industrial base and manufacturing output.

The fabless firms are so lean with the advantage of focusing 110% of their attention on engineering and then get to sit back while TSMC - who is able to focus 110% of their attention on advanced manufacturing and process technology - cranks their designs out for them. Intel is attempting to do both at a bleeding edge level and it hit snags on the latter over the last few years. I don't think people appreciate the insanity of how difficult that actually is in today's industry.

So to say, "Nah, not only are we not going fabless and closing shop on our in-house American manufacturing and the hundreds of thousands of jobs it supports throughout our supply chain, we're going to increase capacity. And not only that, we're opening a foundry business to eat TSMC's lunch and simultaneously reclaim process technology supremacy." -- it's one thing to claim that, another to actually secure multiple deals and partnerships with ASML, AWS, IBM and Qualcomm while throwing down $120 billion in capital to see it all through. I reckon the mega-fab site will be in New York state, in @bobgeese backyard.

Yet another positive headline today. It's been nothing but positive headlines for several months. Things continue to look better and better for Intel.

Intel locks down all remaining TSMC 3nm production capacity, boxing out AMD and Apple

You gotta love the short term plan of leveraging TSMC manufacturing to bring advanced and competitive products to market while it aggressively works to reclaim process technology supremacy from TSMC and simultaneously eat into its foundry business.

As much as I'd love to see them succeed - they only brought an entire industry ecosystem to my city - I wouldn't have bought it for a second if they hadn't already locked up ASML's next generation lithography tech and secured a contract to produce Qualcomm's chips.

Gelsinger is brazen and savvy as fuck.

Do you think Global Foundries will ever get back to competing with TSMC and Intel?

That is pretty bold. Wow, very aggressive of Intel here. And interesting move imho.Yet another positive headline today. It's been nothing but positive headlines for several months. Things continue to look better and better for Intel.

Intel locks down all remaining TSMC 3nm production capacity, boxing out AMD and Apple

Back in March, CEO Pat Gelsinger's announced that Intel would open up both its current and planned manufacturing capacity to other chipmakers through the launch of Intel Foundry Services (IFS); its first customers will be Snapdragon SoC maker Qualcomm and Amazon

A necessary investment for when China annexes Taiwain.

They also detailed their plans to go below 3nm form factor.

Intel always has

I'm optimistic about how aggressively they've undertaken measures with a focus on a return to engineering supremacy since they finally installed a CEO with an actual background in engineering. I like their short terms prospects far more than I did a few years ago. They seem less obsessed with the more esoteric functions of CPUs. Obviously, I was never a long-term bear on Intel. There is a long-running thread in the VG where I mock the profound ignorance required to believe that "Intel is fucked".

I see the short bus has entered the thread.

I have a tendency to get a little overexcited about various topics and slightly exaggerate. But not with this topic or thread, Intel is truly not fucking around. I almost can't even believe what they're doing or how aggressive they're acting. This would make sense too and give them a solid base of capital assets and customers to get into the game while their new foundry plants are under construction.

And even sooner than I expected. I really don't feel like typing all the shit I wrote over the last few days out again, so to recap:

People were already pretty stupid to write off the OG to begin with, and in a few short years they're going to really feel it. By 2025 it will have put AMD to sleep, retaken the lead in process technology from TSMC and become a leading global foundry in addition to the in-house production of its own chips. Gelsinger is a gunslinger making Boss moves with acquisitions, capital expenditures, clientele contracts, manufacturing road maps, leveraging industry investments and relationships plus quantum computing R&D to boot.

Intel will be the foundry manufacturing Qualcomm's most advanced chips in 2024. That isn't a prediction, it's a done deal. They've also already got the business of Amazon Web Services locked up. This is in part because Intel has a tangible stake in the capital equipment manufacturer ASML, and will be the very first in line for its High-NA extreme lithography machines before TSMC and Samsung can get their hands on them. It's hilarious how less than six months ago, the speculation was that they may actually give up and go fabless only for them to turn around and triple down on manufacturing. US Manufacturing.

If the CCP we're to invade Taiwan and/or TSMC fabs went offline or became inoperable, it wouldn't just be devastating for the semiconductor industry or technology sector, it would upend markets and supply chains the entire world over with disastrous ripple effects and impact on the global economy at large. With that said, the proprietary know-how is still of far greater significance because it isn't so much the infrastructure or fabrication plants themselves that are of the greatest value, but the capital equipment assembled and tuned within them. The IP for and production of that machinery is exclusively within the grip of five firms based in the US, Netherlands, and Japan.

As important of a hub TSMC is for producing the core tech that makes the modern world run, it is entirely dependent on those inputs to advance manufacturing and process technology. It also does not engineer any microchips itself, but takes and produces the designs of a US corporation client base. At this juncture, the biggest obstacle for why the CCP can't mount a national semiconductor industry of its own is because it has been choked off from access to the materials, machinery, equipment, software and services required to raise one.

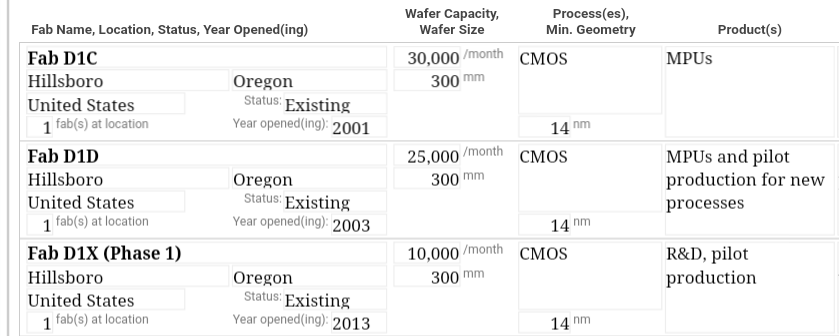

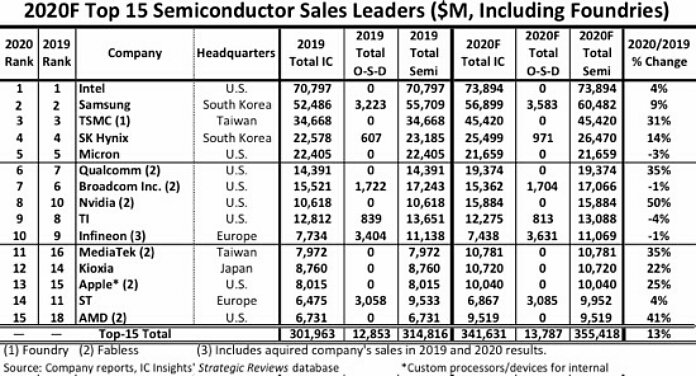

For it's part, Intel is neither a foundry like TSMC nor is it a TSMC customer. It both engineers and manufactures its own chips with complete end-to-end control over production that is overwhelming based within the United States. They build American plants at a incredibly consistent if not constant rate (see below). The big development over the last six months and what I was referring to is that it has decided to expand into the industry segment of what TSMC does by manufacturing the chip designs of other companies with it's own foundry services arm. It can be presumed this will also come with a lot of US government backing - something it has never been dependent on - based on what a successful operation would do to rebalance if not shift the global supply chain back in towards America.

The aggressive demeanor of the CCP towards its regional neighbors and Taiwan in particular over the last few years also now has them looking to offshore tech assets and cutting edge production into the United States themselves.

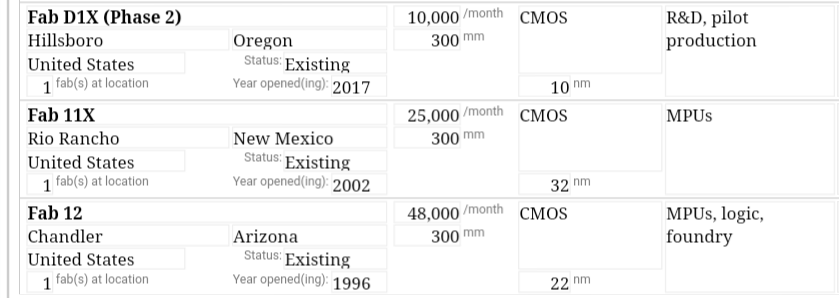

TSMC accounts for over half of foundry output and sales but not wafer capacity on the whole. It's actually Samsung who holds the number one spot, because they also produce their own chips and have majority market share of the memory chip segment (especially DRAM) in addition to a foundry business and client base. The top six account for nearly 60% of global wafer capacity.

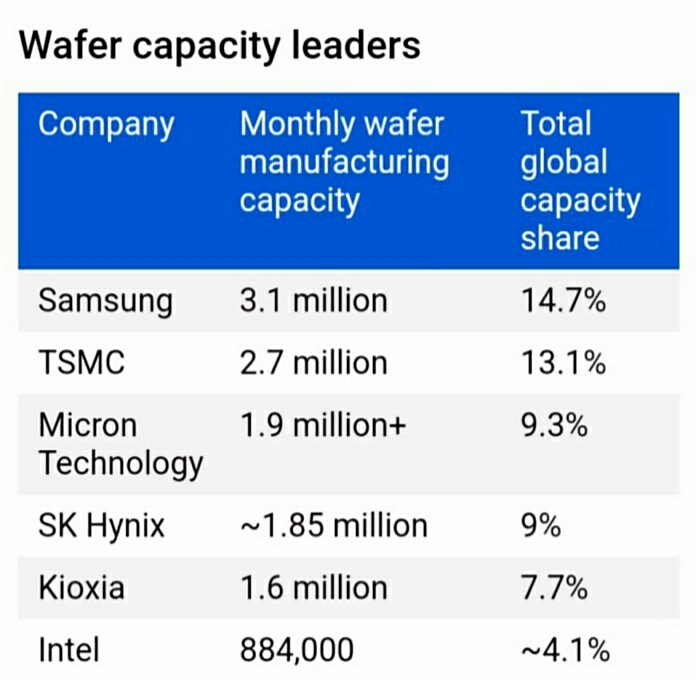

Of course, production capacity is also a very different thing from revenue. Intel remains dominant on that front with $73.8 billion in sales last year -- their bread-and-butter microprocessors for computers and data centers is an absolute cash cow, and they still hold something outrageous like 95+% market share in both segments; around 95% of the world's supercomputers also run on Intel chips.

TSMC and Samsung might be but AMD won’t because they don’t make processors, they rely on fabs like TSMC and Global Foundries to make their stuff for them.2024? I'm not holding my breath. TSMC, AMD and Samsung will probably be in the 2nm business by then. Intel is already two steps behind and its competitors aren't standing in place for it to catch up.

What does Global Foundries offer that Intel doesn’t already have besides physical factory space. Intel already has them beat with their 10nm. That’s assuming the 7nm agreement they have with TSMC would be void in a buyout.

2024? I'm not holding my breath. TSMC, AMD and Samsung will probably be in the 2nm business by then. Intel is already two steps behind and its competitors aren't standing in place for it to catch up.

Yeah, Global Foundries can't produce anything better than 12nm so it isn't a move that would accelerate their goal of reclaiming bleeding edge status. From Intel's perspective, it does provide them an immediate customer base, increased capacity to integrate their internal tech and valuable foundry expertise to gain a foothold and revenue stream.

They don't expect to be ahead until process tech reaches 'sub-2' hence the new Angstrom based nomenclature but the road map is in place and they've already secured first dibs on ASML's next generation lithography tech to actually produce it. There is nothing TSMC and Samsung can do because they are no less - and actually entirely - dependent on ASML equipment for every advance they have made and will make at the future. Ofc, Intel actually needs to start delivering on their production targets in the meantime.

i mean... maybe. pat said that shit and then a couple days later, qualcomm openly denied it during their own ER.

it's also comical that intel is trying to get tsmc to fab for them while simultaneously trying to sell their own fab service. intel doesn't seem to know what the fuck their strategy is.

ain't happening. we've stepped up arms sales to taiwan over the years and even japan recently stated they'd defend taiwan from ccp.

yeah, that was a disaster.

they literally just renamed their 10nm to "7" and then put out a bizarre roadmap from there with not much to support it.

dumber, pat can't figure out where intel is positioned, as he's made claims that they're leading, bragged about being behind (compared it to cycling, inexplicably - claiming it's better to NOT be in the lead because leading is too much effort [buy from us, we're lazy?] ), and that they hope to make it to 2nd place at the end of the decade (implying that they're 3rd, at best [which is true] ).

that presentation was kind of bad (even excluding their operator nonsense... or was that their call a few days before?)

nah, not really. they've pumped ~$20B/year into buybacks for the last umpteen years... and while tsmc and samsung were buying euv machines... intel hasn't been.