- Joined

- Dec 31, 2019

- Messages

- 9,022

- Reaction score

- 7,682

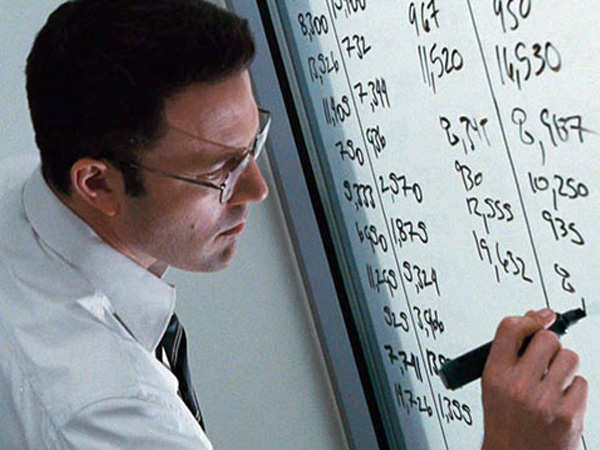

I'm a CPA and I'll just say the minimum requirements for being a CPA aren't the most stringent in my mind. They've gotten a bit harder in recent years when they merged, CMAs, CGAs and CAs together into one governing body, but it was a bit of cake walk for me. You can basically be a B- at your job and your studies and earn it. So there's a decent chance you're talking to an individual who lacks knowledge or tested poorly on certain aspects of their profession. I.e. On a CPA Exam you could score wonderfully on Financial Reporting and Assurance, decent on finance and completely bomb Taxation and still pass the exam. That being said, I have no idea how a receptionist gets her CPA, given there are very specific job requirements to have to earn it. I had to switch jobs 5 times in 7 years to meet all the requirements.

Also, as chickenbrother said we are risk-averse by our very nature and are extremely rules-orientated. We are not here to make you money, we're here to make sure you keep the money you've made. "Faithful Representation" and "Conservatism" are key words/phrases in our profession. We're here to make sure you don't do anything stupid or reckless.

Also, Fuck you too

Also, as chickenbrother said we are risk-averse by our very nature and are extremely rules-orientated. We are not here to make you money, we're here to make sure you keep the money you've made. "Faithful Representation" and "Conservatism" are key words/phrases in our profession. We're here to make sure you don't do anything stupid or reckless.

Also, Fuck you too